JSC National Atomic Company “Kazatomprom” (“Kazatomprom”, “KAP” or “the Company”) announces the following operations and trading update for the first quarter ended 31 March, 2023.

This update provides a summary of recent developments in the uranium industry, as well as provisional information related to the Company’s key first-quarter operating and trading results, and current 2023 guidance. The information contained in this Operations and Trading Update may be subject to change.

Market Overview

Although the Russian nuclear industry has remained unaffected by sanctions, growing anti-Russian sentiment among lawmakers in the UK, the EU and the US led to certain new initiatives and actions since the start of the 2023:

- UK announced a new package of sanctions and economic restrictions aimed at the Russian Federation. The broad restrictions target export bans on every item allegedly used by Russia in the conflict to date. Senior Rosatom executives have been added to the sanctioned list as well.

- Poland, Latvia, Lithuania and Estonia suggested including Russian nuclear energy sector in the European Union’s 11th package of sanctions, which would target Rosatom’s board members, prevent new contracts and limit imports of Russian enriched uranium. According to the latest announcement made by the German Economy Ministry, Germany is also urging the EU to include the Russian civilian nuclear sector in the EU's new sanctions package.

- Seven US Senators introduced a bipartisan bill to ban imports of Russian uranium, which is a companion to the bill, introduced earlier in the US House of Representatives. The bill is aimed at prohibiting imports of low enriched uranium (LEU) from Russia beginning no later than 90 days after enactment, with waivers available until January 1, 2028.

- Subsequent to the quarter end, US Department of State imposed sanctions on more than 80 Russian entities and individuals, including five entities and one individual that are part of Rosatom. The sanctions are intended to limit Russian nuclear technology exports and reduce Russia's political and economic influence on its customers across the world, however, the sanctions appear to have no effect on Rosatom's nuclear fuel business.

- Also following the end of the first quarter, on a G7 meeting in Sapporo, UK, US, Canada, Japan and France formed an alliance to undermine Russia’s position on the nuclear fuel market. This implies a stronger cooperation between the alliance members and the potential for additional sanctions against Rosatom.

Bulgaria's latest proposed 30-year energy strategy, covering the years 2023-2053, outlines the country's efforts to both decarbonize the energy industry and assure energy security in the face of the current industrial concerns, including the climate crisis. To ensure supply security, the energy plan projects coal-fired power stations operating until around 2030. The Bulgarian government has stated that work will commence on constructing two more reactors to the current Kozloduy NPP to supplement the 2 GWe of generation capacity.

The French Senate has passed a draft bill aimed at speeding procedures for building the new nuclear facilities near existing nuclear sites, as well as the operation of existing facilities. The approved legislation removes the goal of reducing France's nuclear share of power production to 50% by 2035. Nuclear power would account for more than 50% of total electricity output by 2050. Furthermore, the provisions specify SMRs as prospective reactor types to be built.

Beyond policy highlights, several demand-side announcements took place during the first quarter:

- In January, Slovenské Elektrárne announced that the Mochovce unit 3 started supplying electricity to Slovakia's national grid. Mochovce unit 3 is Russian-designed VVER-440 PWR with an installed capacity of 471 MWe.

- Southern Co.’s subsidiary Georgia Power reported that Vogtle unit 3 located near Augusta, Georgia, US has been successfully connected to the electrical grid, making it the first Westinghouse AP1000 PWR in the US to achieve this milestone.

- Belgium's Tihange unit 2, a 1,055 MWe PWR, has been permanently shut down after 40 years of service, in compliance with Belgian nuclear phase-out legislation enacted in 2003. It is the second reactor closure under the legislation with Doel unit 3 shut down taking place in September 2022.

- In Taiwan, Taipower's Kuosheng unit 2 was permanently shut down after its 40-year license expired. Taiwan's nuclear phase-out programme calls for reactors to be shut down after their initial 40-year licenses expire. Taiwan's two remaining operational reactors, Maanshan units 1 and 2, are scheduled to shut down in 2024 and 2025, respectively.

- China National Nuclear Power, an operating company of China National Nuclear Corp., announced the pouring of the first tank of nuclear safety-related initial concrete at the Sanmen unit 4. Sanmen units 3 and 4 are Chinese-localized CAP1000 reactors with a total capacity of 1,250 MWe.

- Krško, Slovenia's only nuclear power plant, has received an environmental permission to extend its lifetime from 40 to 60 years and will be able to operate until 2043. Krško supplies about 36% of the country's total power consumption. Slovenia and Croatia jointly own the plant, and its continued operation is critical to both nations' energy security.

- The Finnish government extended the operation license for Fortum’s Loviisa units 1 and 2 until the end of 2050. The licenses for the two VVER-440 reactors at Loviisa units 1 and 2 were slated to expire in 2027 and 2030, respectively.

- Armenia's government has granted a 10-year operating life extension for the country's sole operational VVER-440 PWR at Metzamor unit 2. The government emphasizes that extending Metzamor unit 2's operational life, as well as potentially developing other reactors, is critical to Armenia's economy, as the reactor generates nearly 40% of the country's electricity annually.

- The U.S. Export-Import Bank and U.S International Development Finance Corporation may lend up to $4 billion to Orlen Synthos Green Energy’s project to deploy small modular reactors (SMR) in Poland. This follows news that the government of Poland chose Westinghouse Electric Co. for the country’s flagship nuclear power plant in northern Poland.

On the supply side, Cameco Corporation anticipates producing 33 million pounds of U3O8 (100% basis) in 2023, with Cigar Lake producing 18 million pounds of U3O8 and McArthur River/Key Lake producing 15 million pounds of U3O8. Furthermore, with the uranium market improving and Cameco's ability to secure new long-term contracts, the company has updated its 2024 production plan and expects to produce 36 million pounds U3O8 (100% basis), up from 28.5 million pounds of U3O8 according to previous plans, with both Cigar Lake and McArthur River/Key Lake producing at 18 million pounds U3O8 per year.

Following the completion of a feasibility study, China National Nuclear Corp.'s Rossing mine in Namibia was granted a 10-year mine life extension until 2036. Development of Rossing Uranium, Namibia’s oldest commercial uranium mine which commenced production in 1976, produced approximately 5% of global output in 2022.

Subsequent to the first quarter, as part of a long-planned transition to renewable energy, Germany shuts down its final three nuclear power plants in operation: Emsland (1,335 MWe PWR), Isar 2 (1,410 MWe PWR), and Neckarwestheim 2 (1,310 MWe PWR). The German government has acknowledged that the country will be reliant on polluting coal and natural gas to meet its energy demands in the short term, despite taking steps to massively ramp up electricity output from solar and wind.

Market Pricing and Activity

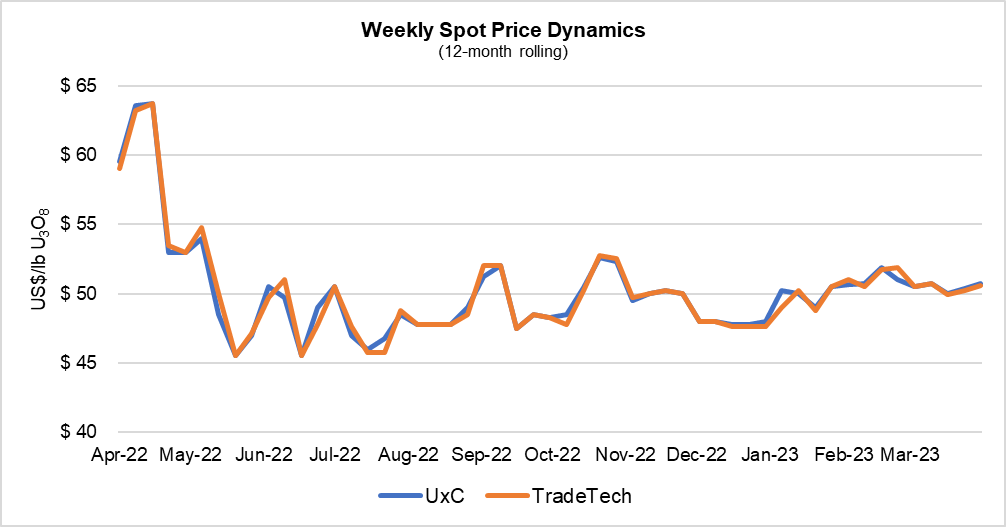

The resumption of spot market activity following the holiday season and an increase in financial demand resulted in gradual growth of the spot price throughout the first two months of 2023, with an average high of weekly spot indicators of US$51.80. Since then, the spot price has been under pressure as financial markets have fallen and concerns about the health of the banking system have grown. According to third-party market data, spot volumes transacted through the first three months of 2023 were more than twice as low as in the same period last year. A total of 9.6 million pounds U3O8 (~3,700 tU) was transacted at an average weekly spot price of US$50.35/lb U3O8, compared to about 21.9 million pounds U3O8 (~8,400 tU) at an average weekly spot price of US$47.96/lb U3O8 in the first quarter of 2022.

In the term market, activity was a little lower than in previous year, with third-party data indicating that contracted volumes totaled about 52 million pounds U3O8 (20,000 tU) through the first quarter of 2023, compared to about 59 million pounds U3O8 (22,700 tU) in the first quarter of 2022. Despite lower activity, the long-term price increased by about US$4.00/lb U3O8 year-over-year, to US$53.00/lb U3O8 (reported only on a monthly basis by third-party sources).

Company Developments

Corporate Update

As was previously disclosed, the Kazatomprom Group has established a subsidiary «Taiqonyr Qyshqyl Zauyty» LLP – sulphuric acid plant. The start of construction of the sulfuric acid plant is planned in 2024, and the start of production and reaching full design capacity of 800 thousand tons are expected in 2026. The participants of the entity are comprised of Kazatomprom with a stake of 49%, RU-6 LLP with a stake of 25%, and Kazatomprom-SaUran LLP with a stake of 26%, respectively.

Another corporate structural change that has taken place in April 2023, was the completion of the divestment process of Caustic JSC as part of agreement concluded on 30 December 2021 with United Chemical Technologies LLP. Kazatomprom has received the payment for the remaining 28% stake in Caustic JSC. The total amount of proceeds from the sale of Kazatomprom's stake in Caustic JSC, including interest of KZT 163 million, amounted to about KZT 1.4 billion.

Extension of Subsoil Use Contracts

In January 2023, Kazatomprom-SaUran LLP and the Ministry of Energy of the Republic of Kazakhstan (“the Ministry”) signed addenda to the uranium mining contracts for Kanzhugan and Eastern Mynkuduk deposits, which provide for the extension of the subsoil use rights validity period. Subsoil use rights at Kanzhugan deposit were extended through to 2047 and at Eastern Mynkuduk deposit were extended through to 2027 respectively.

On the same day, an addendum to the contract for uranium mining at Northern Karamurun and Southern Karamurun deposits was signed between RU-6 LLP and the Ministry. The addendum to the contract provides for the extension of the validity of the subsoil use rights at these two mines up until 2040.

Transportation risk mitigation

Some of the Group’s exported products are transported through the Russian Federation, accordingly, there are risks associated with transit through the territory of Russia, insurance and the delivery of cargo by sea vessels. Kazatomprom constantly monitors the potential impact of sanctions on the transportation of finished products. At the date of this document, there are no restrictions on the Company’s activities related to the supply of products to end customers. Kazatomprom also has permission to transit uranium through the Trans-Caspian International Transport Route (“TITR”), which it has successfully used as an alternative route since 2018 to help mitigate the risk of the primary route being unavailable, for any reason.

Furthermore, on top of the Company’s ability to negotiate swaps with its partners and customers, as well as the Company’s inventories at a number of global locations, Kazatomprom is working on difersifying the routes, including the transit through the territory of the People’s Republic of China.

Delivery to Eastern Europe

As was disclosed previously, Kazatomprom successfully delivered natural uranium concentrates to Societatea Natională "Nuclearelectrica" S.A., a Romanian state-owned utility, operating the Cernavodă NPP. In accordance with the terms of the contract, the parties fulfilled all their obligations. The Company exported its products via TITR and will continue to diversify the geography of deliveries and a customer base.

AGM Notice, Dividends recommendation, and a Major Transaction

Subsequent to the first quarter, on 7 April 2023, KAP announced the results of the Company’s Board of Directors meeting, convened in Astana on 6 April 2023.

The Board made a number of decisions, including the timing and format for the Company’s Annual General Meeting of Shareholders (“AGM”), and a recommendation for a dividend payment of KZT 774.88 per ordinary share (one GDR equal to one ordinary share). If approved by AGM, the total dividend will amount to approximately KZT 200.97 billion.

Furthermore, in accordance with the Law on Joint Stock Companies of the Republic of Kazakhstan, the Board of Directors submitted the issue of concluding of a major transaction for the approval by AGM, as a result of which the Company could realize the uranium products, valued at more than fifty percent of the total book value of the Company’s assets.

The notice of the upcoming in-absentia AGM, scheduled on 25 May 2023, and detailed information on the AGM agenda are available on the Company’s website, www.kazatomprom.kz.

Kazatomprom’s Board of Directors

As disclosed earlier in 2023, based on the voting results of the EGM held on February 3, 2023, Mr. Armanbay Zhubaev was elected as an independent director of the Company’s Board of Directors. With the election of Mr. Zhubaev, the share of independent directors in the Company's Board of Directors reached 50%. All the Committees of the Board of Directors are governed by independent directors.

Full biographies of the Board of Directors are available on the Company’s website: www.kazatomprom.kz.

Kazatomprom’s 2022 Integrated Annual Report

The text-only version of the 2022 Integrated Annual Report approved by the Company’s Board of Directors will be published today at Kazatomprom’s website, www.kazatomprom.kz, in accordance with the requirements of the listing rules of stock exchanges. A fully interactive electronic version of the Report will be made available on the Company’s website no later than 30 June 2023.

Kazatomprom’s 2023 First-Quarter Operational Results1

|

|

Three months ended March 31 |

|

|

|

(tU as U3O8 unless noted) |

2023 |

2022 |

Change |

|

U3O8 Production volume (100% basis)2 |

4,744 |

4,954 |

(4%) |

|

U3O8 Production volume (attributable basis)3 |

2,517 |

2,685 |

(6%) |

|

Group U3O8 sales volume4 |

6,142 |

2,596 |

137% |

|

KAP U3O8 sales volume (incl. in Group)5 |

6,142 |

2,355 |

161% |

|

Group average realized price (USD/lb U3O8)6* |

46.75 |

39.36 |

19% |

|

KAP average realized price (USD/lb U3O8)7* |

46.75 |

37.74 |

24% |

|

Average month-end spot price (USD/lb U3O8)8* |

50.68 |

50.01 |

1% |

2 U3O8 Production volume (100% basis): Amounts represent the entirety of production of an entity in which the Company has an interest; it therefore disregards the fact that some portion of that production may be attributable to the Group’s joint venture partners or other third party shareholders. Actual drummed production volumes remain subject to converter adjustments and adjustments for in-process material.

3 U3O8 Production volume (attributable basis): Amounts represent the portion of production of an entity in which the Company has an interest, which corresponds only to the size of such interest; it therefore excludes the remaining portion attributable to the JV partners or other third party shareholders, except for production from JV “Inkai” LLP, where the annual share of production is determined as per the Implementation Agreement disclosed in the IPO Prospectus. Actual drummed production volumes remain subject to converter adjustments and adjustments for in-process material.

4 Group U3O8 sales volume: includes the sales of U3O8 by Kazatomprom and those of its consolidated subsidiaries (companies that KAP controls by having (i) the power to direct their relevant activities that significantly affect their returns, (ii) exposure, or rights, to variable returns from its involvement with these entities, and (iii) the ability to use its power over these entities to affect the amount of the Group’s returns. The existence and effect of substantive rights, including substantive potential voting rights, are considered when assessing whether KAP has power to control another entity). For consistency, Group U3O8 sales volumes do not include other forms of uranium products (including, but not limited to the sales of fuel pellets).

5 KAP U3O8 sales volume (incl. in Group): includes only the total external sales of U3O8 of KAP HQ and Trade House KazakAtom AG (THK). Intercompany transactions between KAP HQ and THK are not included.

6 Group average realized price (USD/lb U3O8): average includes Kazatomprom’s sales and those of its consolidated subsidiaries, as defined in parenthesis in footnote 4 above.

7 KAP average realized price (USD/lb U3O8): the weighted average price per pound for the total external sales of KAP HQ and THK. The pricing of intercompany transactions between KAP HQ and THK are not included.

8 Source: UxC LLC, TradeTech. Values provided are the average of the month-end uranium spot prices quoted by UxC and TradeTech, and not the average of each weekly quoted spot price throughout the month. Contract price terms generally refer to a month-end price.

* Please note that the conversion ratio of kgU to pounds U3O8 is 2.5998.

Both production on a 100% basis and production on an attributable basis were slightly lower in the first quarter of 2023 compared to the same period in 2022, due to to an insignificant decrease in the production plan both for 2023 and for the first quarter of 2023 in particular, in accordance with the previously announced Company’s guidance.

Of note, previously announced production guidance range and the production plan for 2023 correspond to minus 20% from subsoil use contracts. As indicated earlier, the decrease in the production guidance indicators for 2023 compared to the factual volume of 2022 is associated with the delays in commissioning technological blocks (wells) into operation, resulting from the shifts and delays in the delivery of certain materials and equipment in 2022. It is planned that the Company levels out the backlog in the schedule for commissioning wells, and at the moment, maintains the current level of expectations for annual production for 2023.

In the first quarter of 2023, both Group and KAP sales volumes were significantly higher compared to the same period in 2022, primarily due to the timing of customer-scheduled deliveries. Sales volumes can vary substantially each quarter, and quarterly sales volumes vary year to year due to variable timing of customer delivery requests during the year, and physical delivery activity.

Average realized price for the first quarter of 2023 was higher compared to the same period in 2022 due to a higher uranium spot price. The Company’s current overall contract portfolio pricing correlates to uranium spot prices. However, as deliveries under some long-term contracts in the first quarter of 2023 incorporated a proportion of fixed pricing that was negotiated prior to the sharp increase in spot price, the average realized price was slightly lower than the average month-end spot price.

In the uranium market, the trends in quarterly metrics and interim results are rarely representative of annual expectations; for annual expectations, please see the Company’s guidance metrics below, as well as its price sensitivity table from section 12.1 Uranium sales price sensitivity analysis, in the Company’s Operating and Financial Review for 2022.

Kazatomprom’s 2023 Reiterated Guidance

|

(exchange rate 470 KZT/1USD) |

2023 |

|

Production volume U3O8 (tU) (100% basis)1,2 |

20,500 – 21,5002 |

|

Production volume U3O8 (tU) (attributable basis)3 |

10,600 – 11,2002 |

|

Group U3O8 sales volume (tU) (consolidated)4 |

15,400 – 15,900 |

|

Incl. KAP U3O8 sales volume (incl. in Group) (tU)5 |

12,100 – 12,600 |

|

Revenue - consolidated (KZT billions)6 |

1,080 – 1,090 |

|

Revenue from Group U3O8 sales, (KZT billions)6 |

820 – 840 |

|

C1 cash cost (attributable basis) (USD/lb)* |

$12.00 – $13.50 |

|

All-in sustaining cash cost (attributable C1 + capital cost) (USD/lb)* |

$20.00 – $21.50 |

|

Total capital expenditures of mining entities (KZT billions) (100% basis)7 |

240 – 250 |

1 Production volume (100% basis): Amounts represent the entirety of production of an entity in which the Company has an interest; it disregards that some portion of production may be attributable to the Group’s JV partners or other third-party shareholders.

2 The duration and full impact of the Russian-Ukrainian conflict and the COVID-19 pandemic are not yet known. Annual production volumes could therefore vary from internal expectations.

3 Production volume (attributable basis): Amounts represent the portion of production of an entity in which the Company has an interest, corresponding only to the size of such interest; it excludes the portion attributable to the JV partners or other third-party shareholders, except for JV “Inkai” LLP, where the annual share of production is determined as per Implementation Agreement as disclosed in IPO Prospectus. Actual drummed production volumes remain subject to converter adjustments and adjustments for in-process material.

4 Group sales volume: includes Kazatomprom’s sales and those of its consolidated subsidiaries (according to the definition of the Group provided on page one of this document). Group U3O8 sales volumes do not include other forms of uranium products (including, but not limited to, the sales of fuel pellets).

5 KAP sales volume: includes only the total external sales of KAP HQ and THK. Intercompany transactions between KAP HQ and THK are not included.

6 Revenue expectations are based on uranium prices taken at a single point in time from third-party sources. The prices used do not reflect any internal estimate from Kazatomprom, and 2023 revenue could be materially impacted by how actual uranium prices and exchange rates vary from the third-party estimates.

7 Total capital expenditures (100% basis): includes only capital expenditures of the mining entities, includes significant CAPEX for investment and expansion projects. Excludes liquidation funds and closure costs. For 2023 includes well construction and mine development costs of JV Budenovskoye LLP and JV Katco LLP (South Tortkuduk) for a total amount of approximately KZT 70 billion.

* Please note that the conversion ratio of kgU to pounds U3O8 is 2.5998.

All 2023 guidance metrics remain unchanged at this time from expectations disclosed earlier in the year.

Revenue, C1 cash cost (attributable basis) and All-in Sustaining cash cost (attributable C1 + capital cost) may vary from the ranges shown, to the extent that the KZT-to-USD exchange rate and uranium spot price differ significantly from the Company’s assumptions.

The Company only intends to update annual guidance in relation to operational factors and internal changes that are within its control. Key assumptions used for external metrics, such as exchange rates and uranium prices, are established using third-party sources during the Company’s annual budget process in the previous year; such assumptions will only be updated on an interim basis in exceptional circumstances.

Kazatomprom continues to target an inventory level of approximately six to seven months of annual attributable production. During the first quarter of 2023, several transactions to purchase material in the spot market were carried out and the Company will continue to monitor market conditions for opportunities to optimize its inventory levels.

For further information, please contact:

Kazatomprom Investor Relations Inquiries

Yerlan Magzumov, Director of Investor Relations

Tel: +7 7172 45 81 80

Email: ir@kazatomprom.kz

Kazatomprom Public Relations and Media Inquiries

Sabina Kumurbekova, Director of the PR Department

Gazhaiyp Kumisbek, Chief Expert of the PR Department

Tel.: +7 7172 45 80 22

Email: pr@kazatomprom.kz

Copy of this announcement will be available at www.kazatomprom.kz.

About Kazatomprom

Kazatomprom is the largest uranium producer in the world with natural uranium production in proportion to the Company's participatory interest in the amount of about 22% of the total global primary uranium production in 2022. The group has the largest uranium reserve base in the industry. Kazatomprom, together with subsidiaries, affiliates and joint organisations, is developing 26 deposits combined into 14 uranium-mining enterprises. All uranium mining enterprises are located on the territory of the Republic of Kazakhstan and when mine uranium use in-situ recovery technology, paying particular attention to best HSE practices and means (ISO 45001 and ISO 14001 certified).

Kazatomprom's securities are listed on the London Stock Exchange, the Astana International Exchange and the Kazakhstan Stock Exchange. Kazatomprom is the National Atomic Company of the Republic of Kazakhstan, and the main customers of the group are operators of nuclear generating capacities, and the main export markets for products are China, South and East Asia, North America and Europe. The Group sells uranium and uranium products under long-term and short-term contracts, as well as on the spot market directly from its corporate centre in Astana, Kazakhstan, as well as through a trading subsidiary in Switzerland, Trading House KazakAtom (THK).

For more information, please, visit our website www.kazatomprom.kz.

Statements for the Future

All statements, other than statements of historical fact, included in this message or document are statements regarding the future. Statements regarding the future reflect the Company's current expectations and estimates regarding its financial condition, results of operations, plans, goals, future results and activities. Such statements may include, but are not limited to, statements before which, after which or where words such as “goal”, “believe”, “expect”, “intend”, “possibly”, “anticipate”, “evaluate”, “plan”, “project”, “will”, “may”, “probably”, “should”, “may” and other words and terms of a similar meaning or their negative forms are used.

Such statements regarding the future include known and unknown risks, uncertainties and other important factors beyond the control of the Company, which may lead to the fact that the actual results, indicators or achievements of the Company will significantly differ from the expected results, indicators or achievements expressed or implied by such statements regarding the future. Such statements regarding the future are based on numerous assumptions regarding the current and future business strategy of the Company and the conditions in which it will operate in the future.

INFORMATION ON THE ESTIMATES CONTAINED IN THIS DOCUMENT ARE BASED ON SEVERAL ASSUMPTIONS ABOUT FUTURE EVENTS AND ARE SUBJECT TO SIGNIFICANT ECONOMIC AND COMPETITIVE UNCERTAINTIES AND OTHER CONVENTIONALITIES, NONE OF WHICH CAN NOT BE PREDICTED WITH CERTAINTY AND SOME OF WHICH ARE OUTSIDE OF THE COMPANY'S CONTROL. THERE CAN NOT BE ANY WARRANTY THAT THE ESTIMATES WILL BE REALISED AND THE ACTUAL RESULTS MAY BE ABOVE OR BELOW THAN SPECIFIED. NONE OF THE COMPANY - NO SHAREHOLDERS, NO DIRECTORS, NO OFFICERS, NO EMPLOYEES, NO CONSULTANTS, NO AFFILIATES NOR ANY REPRESENTATIVES OR AFFILIATES LISTED ABOVE BEAR RESPONSIBILITY FOR THE ACCURACY OF THE ESTIMATES PRESENTED IN THIS DOCUMENT.

The information contained in this message or document, including, but not limited to, statements regarding the future, is applicable only as of the date of this document and is not intended to provide any guarantees regarding future results The Company expressly disclaims any obligation to disseminate updates or changes to such information, including financial data or forward-looking statements, and will not publicly release any changes that it may make to information arising from changes in the Company's expectations, changes in events, conditions or circumstances on which such statements regarding the future are based, or in other events or circumstances arising after the date of this document.