JSC National Atomic Company “Kazatomprom” (“Kazatomprom”, “KAP” or “the Company”) announces the following operations and trading update for the fourth quarter and year ended 31 December, 2018.

This update provides a summary of recent developments in the uranium industry, as well as provisional information related to the Company’s key 2018 operating and trading results and 2019 operating and trading guidance. The information contained in this Operations and Trading Update may be subject to change. It may differ from the final audited results to be provided in the 2018 Operating and Financial Review, which is expected to be released on 6 March, 2019.

Market Overview

After a prolonged period of oversupply in the uranium market, 2018 saw a shift in balance toward undersupply, with the market being in slight deficit. The shift can be partially attributed to emerging interest in physical uranium from financial institutions throughout the year, although major production cuts from the world’s largest uranium producers played a prominent role in the modest improvement. In Kazakhstan, uranium production was reduced by 20% against planned levels under Subsoil Use Agreements. In Canada, Cameco Corporation took one of the world’s most significant single sources of uranium out of the near-term supply stack when it suspended production from its McArthur River / Key Lake uranium mine for an indeterminate period.

The supply side improvements were met with mixed developments on the demand side. In the near-term, ongoing uncertainty related to the potential introduction of uranium import quotas or tariffs, stemming from the United States Department of Commerce’s (DOC) investigation under Section 232 of the U.S. Trade Expansion Act (1962), contributed to a continued lack of significant long-term contracting activity in the market. According to the Act, the DOC is expected to complete its investigation within a 270-day period (ending mid-April 2019) and provide the President of the United States with recommendations, who then has 90 days to make a final decision. The impact of the recent US government shutdown on these timelines remains unknown.

The demand news from a medium- to longer-term perspective was more balanced. On one side, the United Arab Emirates’ Nawah Energy Company updated the reactor construction schedule for Barakah-1, indicating it is not expected to come on line before 2020 (previously 2018). Additionally, the pace of reactor restarts in Japan remained slow, with only nine units approved to operate at the end of 2018 (five more than the end of 2017). However, from a more positive demand perspective, the French government announced a new energy policy, in which previous plans to reduce nuclear’s share of power generation to 50% were delayed until 2035 (previous target was 2025). Adding to the positive global policy improvements, a referendum in Taiwan regarding the potential abolishment of nuclear power was defeated with nearly 60% of votes against the plan, which may help improve public opinion in the country. Finally, South Korea’s nuclear phase-out policy faced growing pressure, as a national campaign coordinated by civic organizations collected over 300,000 signatures opposing that government’s nuclear-free energy plan.

Spot Market

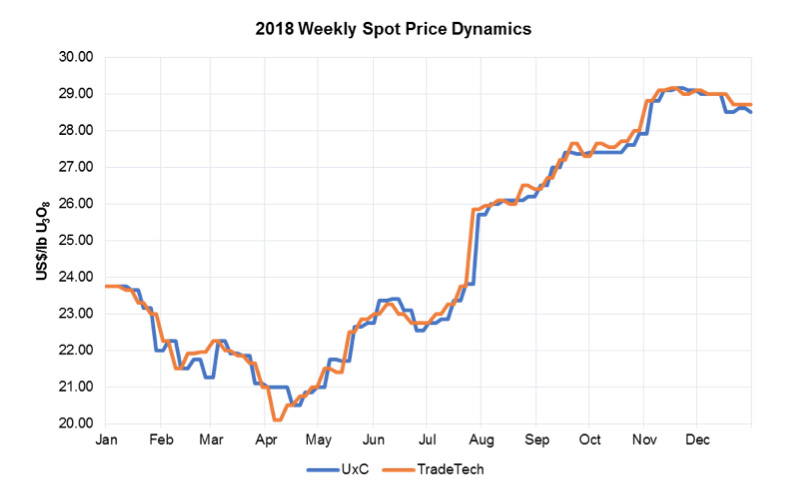

It was a record-breaking year in the spot market in 2018, with nearly 90 million pounds contracted for delivery within 12 months (data from UxC). The spot price at the outset of the first quarter was US$23.75 per pound U3O8, reflecting the market’s initial reaction to a reduction of excess supply of uranium products. As uncertainty began to set in, the price gradually drifted to the 2018 low of US$20.10 per pound U3O8 in mid-April.

Additional demand began to materialize in May and it generally persisted, supporting a gradual improvement of the spot price to US$22.55 per pound U3O8 by the end of June. More substantial improvement was marked by the July initial public offering (IPO) of Yellow Cake plc, which acquired over 8 million pounds of U3O8 from the spot market. Later that month, Cameco Corporation’s announcement that the McArthur River facilities would remain shut down for an indeterminate period due to weak market conditions, helped trigger a further rise in the spot price. The spot price peaked at US$29.15 in the fourth quarter, shortly after Kazatomprom’s IPO, with public trading of the Company shares and global depository receipts (GDRs) on the Astana International Exchange (AIX), and GDRs on the London Stock Exchange (LSE).

At year-end, the spot price fell to US$28.60 per pound U3O8 as some market intermediaries tried to make final sales prior to the close of the year.

Long-term Market

In the long-term market, prices started the year at US$30.00 per pound U3O8 and essentially remained within a two-dollar range above and below that value throughout 2018. The modest appreciation and depreciation of the long-term price was correlated with the variation in spot price during the year, although there continued to be a general lack of contracting in the term market.

|

|

Three months ended December 31 |

Change |

Year ended December 31 |

Change |

||

|

(tU as U3O8 unless noted) |

2017 |

2018 |

2017 |

2018 |

||

|

Production volume (100% basis)2 |

6,269 |

5,763 |

(8)% |

23,321 |

21,705 |

(7)% |

|

Production volume (attributable basis)3 |

3,226 |

2,919 |

(10)% |

12,093 |

11,476 |

(5)% |

|

Group sales volume4,5 |

3,167 |

4,954 |

56% |

10,111 |

16,648 |

65% |

|

KAP sales volume (incl. in Group) 5,6 |

3,051 |

4,192 |

37% |

9,300 |

15,287 |

64% |

|

KAP average realized price (US$/lb U3O8)6* |

23.87 |

27.87 |

17% |

24.15 |

24.56 |

2% |

|

Average month-end spot price (US$/lb U3O8)7* |

22.32 |

28.27 |

27% |

21.78 |

24.59 |

13% |

1 - All amounts are preliminary and may differ from the final audited results to be provided in the 2018 Operating and Financial Review, which is expected to be released on 6 March, 2019.

2 - Production volume (100% basis): Amounts represent the entirety of production of an entity in which the Company has an interest; it therefore disregards the fact that some portion of that production may be attributable to the Group’s joint venture partners or other third party shareholders. Actual drummed production volumes remain subject to converter adjustments and adjustments for in-process material.

3 - Production volume (attributable basis): Amounts represent the portion of production of an entity in which the Company has an interest, which corresponds only to the size of such interest; it therefore excludes the remaining portion attributable to the joint venture partners or other third party shareholders. Actual drummed production volumes remain subject to converter adjustments and adjustments for in-process material.

4 - Group sales volume: includes Kazatomprom’s sales and those of its consolidated subsidiaries (companies that KAP controls by having (i) the power to direct their relevant activities that significantly affect their returns, (ii) exposure, or rights, to variable returns from its involvement with these entities, and (iii) the ability to use its power over these entities to affect the amount of the Group’s returns. The existence and effect of substantive rights, including substantive potential voting rights, are considered when assessing whether KAP has power to control another entity.

5 - KAP HQ/THK sales volume: includes only the consolidated sales of KAP HQ and Trade House KazakAtom AG (THK). Intercompany transactions between KAP HQ and THK are not included.

6 - KAP HQ/THK average realized price: the weighted average price per pound for the consolidated sales of KAP HQ and THK. The pricing of intercompany transactions between KAP HQ and THK are not included.

7 - Source: UxC, TradeTech. Amounts provided represent the average of the uranium spot prices quoted at month end, and not the average of each weekly quoted spot price. Contract price terms generally refer to a month-end price.

Kazatomprom’s 2019 Guidance

In 2018, Kazatomprom successfully reduced annual mined uranium volumes against planned levels under Subsoil Use Agreements by 20%. Kazakhstan produced 21,705 tU from its mines in 2018; without the 20% reduction, production would have exceeded 27,000 tU in 2018 under Subsoil Use Agreements. The Company fully intends to maintain that 20% reduction against existing license volumes for 2019 and 2020.

In 2019, Kazatomprom expects to produce between 13,000 tU and 13,500 tU on an attributable basis, remaining consistent with the previously announced intention to flex down planned production volumes by 20% for 2018 through 2020 (versus consolidated planned production levels under Subsoil Use Agreements, which were increasing annually over that period). With the flex down, under the existing Subsoil Use Agreements, production is expected to total approximately 22,750 to 22,800 tU (100% basis) in 2019; without the reduction, production would have exceeded 28,500 tU (100% basis) in 2019. The year-over-year increase in Kazakhstan’s overall production levels from 21,705 tU in 2018, to an estimated 22,750 to 22,800 tU in 2019, reflects pre-existing increases under certain Subsoil Use Agreement target volumes, which were established at the time the licenses were issued. Those increases have also been stepped-down by 20% to remain in line with the overall 2018 to 2020 plan.

Kazatomprom expects to continue following a market-centric approach to uranium production, rather than the previous production-focused strategy. By leveraging the in-situ recovery mining method, the Company can adjust production levels and respond to changes in uranium market conditions far more rapidly and cost-effectively than is possible with conventional mining methods.

The guidance for sales remains consistent with Kazatomprom’s market-centric strategy. For 2019, the Company expects to sell between 13,500 tU and 14,500 tU (KAP HQ/THK sales volume). Sales in excess of planned attributable production are expected to be primarily sourced from inventories, and from KAP subsidiaries under contracts and agreements with joint venture partners and other third parties.

The Company expects to maintain an inventory level of approximately six months of annual attributable production at the 2019 year-end.

Conference Call (2018 Operating and Financial Review – 6 March, 2019)

Kazatomprom has scheduled a conference call to discuss the 2018 operating and financial results on Wednesday, 6 March, 2019 at 14:00 (AST) / 08:00 (GMT). The discussion will be followed by a question and answer session with investors. The call will be hosted in both Russian and English, with immediate translation between the two languages as the call progresses.

Interested parties are invited to join the call by dialing +7 (8) 495 249 98 42 in Kazakhstan, +44 (0) 20 3003 2701 in the UK or +1 646 843 4610 in the US, all using the conference pin 8189576#. A live webcast of the conference call will be available from a link at www.kazatomprom.kz home page on the day of the call. A replay will be made available after the call.

For further information, please contact:

Kazatomprom Investor Relations Inquiries

Cory Kos, Head of Investor Relations

Tel: +7 7172 45 81 69

Email: ir@kazatomprom.kz

Kazatomprom Public Relations and Media Inquiries

Tel: +7 7172 45 80 63

Email: pr@kazatomprom.kz

A copy of this announcement will be made available at www.kazatomprom.kz.

About Kazatomprom

Kazatomprom is the world's largest producer of uranium, representing approximately 20% of total global uranium primary production in 2017. The Group benefits from the largest reserve base in the industry. Kazatomprom operates, through its subsidiaries, JVs and Associates, 26 deposits grouped into 13 mining assets, all of which are located in Kazakhstan and mined using ISR technology.

As the national atomic company in the Republic of Kazakhstan, the Company has partnered with substantially all of the leading players in the uranium mining industry globally. The Group's primary customers are operators of nuclear generation capacity, and the principal export markets for the Group's products are China, South and Eastern Asia, Europe and North America. The Group sells uranium and uranium products under long-term contracts, short-term contracts, as well as in the spot market, directly from its headquarters or through its Switzerland-based trading subsidiary, THK.

For more information: http://www.kazatomprom.kz

Forward-looking statements

All statements other than statements of historical fact included in this communication or document are forward-looking statements. Forward-looking statements give the Company’s current expectations and projections relating to its financial condition, results of operations, plans, objectives, future performance and business. These statements may include, without limitation, any statements preceded by, followed by or including words such as “target,” “believe,” “expect,” “aim,” “intend,” “may,” “anticipate,” “estimate,” “plan,” “project,” “will,” “can have,” “likely,” “should,” “would,” “could” and other words and terms of similar meaning or the negative thereof. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors beyond the Company’s control that could cause the Company’s actual results, performance or achievements to be materially different from the expected results, performance or achievements expressed or implied by such forward-looking statements. Such forward-looking statements are based on numerous assumptions regarding the Company’s present and future business strategies and the environment in which it will operate in the future. The information with respect to any projections presented herein is based on a number of assumptions about future events and is subject to significant economic and competitive uncertainty and other contingencies, none of which can be predicted with any certainty and some of which are beyond the control of the company. There can be no assurances that the projections will be realized, and actual results may be higher or lower than those indicated. None of the company nor its shareholders, directors, officers, employees, advisors or affiliates, or any representatives or affiliates of the foregoing, assumes responsibility for the accuracy of the projections presented herein. The information contained in this communication or document, including but not limited to forward-looking statements, applies only as of the date hereof and is not intended to give any assurances as to future results. The Company expressly disclaims any obligation or undertaking to disseminate any updates or revisions to such information, including any financial data or forward-looking statements, and will not publicly release any revisions it may make to the Information that may result from any change in the Company’s expectations, any change in events, conditions or circumstances on which these forward-looking statements are based, or other events or circumstances arising after the date hereof.